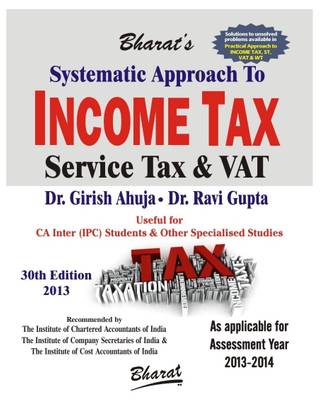

Systematic Approach To Income Tax, Service Tax & Vat 2013-14 (English, Paperback, Gupta Ravi)

- Language: English

- Binding: Paperback

- Publisher: Bharat Law House Pvt Ltd

- Genre: Business & Economics

- ISBN: 9788177339338, 9788177339338

Systematic Approach to Income Tax, Service Tax & VAT 30th Edition is a comprehensive book on corporate taxes for commerce and management students. The book comprises of chapters on income tax, wealth tax, and VAT taxes. In addition, the book follows a step-by-step approach with suitable examples and tables for the students to understand the concepts better. This book is essential for students pursuing CA, CFA, and MBA.

About the Authors

Dr. Girish Ahuja finished his graduation and post-graduation from Shri Ram College of Commerce. He got his PhD from Faculty of management studies, University of Delhi. He has more than 35 years of experience in teaching.

Dr. Ravi Gupta has co-authored this book.

They have authored several books like Professional Approach to Direct Taxes Law & Practice Including Tax Planning: Also Containing Solutions to Questions of CA/CS Final & CWA Exams, Income Tax Rules, Handbook on Tax Deduction at Source with Illustrations and FAQs as Amended by Finance Act, 2013, etc.

| Title |

|

| Imprint |

|

| Product Form |

|

| Latest Version |

|

| Publisher |

|

| Genre |

|

| Source Type |

|

| ISBN13 |

|

| Book Category |

|

| BISAC Subject Heading |

|

| Book Subcategory |

|

| ISBN10 |

|

| Language |

|

- 5★

- 4★

- 3★

- 2★

- 1★

- 11

- 8

- 4

- 2

- 1

A very good book - Systematic Approach to Income Tax, Service Tax & VAT (English) 30th Edition

Sg Acharya

Certified Buyer, Kalyan

Feb, 2015

Greatttttt

Khushpreet Singh Walia

Certified Buyer, New Delhi

Mar, 2014