यह आइटम स्टॉक में आने पर सूचना पाएं.

MCQ ON TAX LAWS THEORY AND PROBLEM BASED MCQ (NEW SYLLABUS) (English, Paperback, K.M. BANSAL, ANJALI AGARWAL)

Share

MCQ ON TAX LAWS THEORY AND PROBLEM BASED MCQ (NEW SYLLABUS) (English, Paperback, K.M. BANSAL, ANJALI AGARWAL)

4.5

19 Ratings & 0 Reviewsख़ास कीमत

₹410

₹460

10% off

बिक गया

यह आइटम अभी स्टॉक में नहीं है

Highlights

- Language: English

- Binding: Paperback

- Publisher: Taxmann Publications

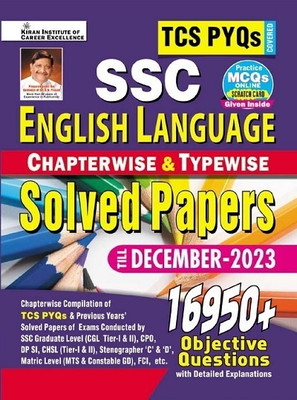

- Genre: Self-Practice books for CS-Executive, ICSI Exam Books , Past Exam Questionnaire

- ISBN: 9789389546903, 9389546907

- Edition: 2nd, 2020

- Pages: 360

Seller

जानकारी

The Present Publication is the 2nd Edition & Updated till 30th November 2019 (New Syllabus), with the following noteworthy features: (1) Coverage: (i) Theory & Problem Based MCQs with Hints for Practical Questions (ii) Previous Year Examination Questions & Answers modified as per assessment year 2020-21 and latest GST Laws (including Dec. 2019 Exam) (iii) Direct Taxes (a) Introduction (b) Basic Concept of Income Tax (c) Incomes which do not form part of Total Income (d) Computation of Income under Various Head (e) Clubbing Provisions and Set-Off and/or Carry Forward of Losses (f) Deduction from Gross Total Income, Rebate and Relief (g) Computation of Total Income and Tax Liability of Various Entities (h) Classification and Tax Incidence on Companies (i) Procedural Compliance (j) Assessment, Appeal & Revision (iv) Indirect Taxes (a) Concepts of Indirect Taxes at a Glance (b) Basic of Goods and Services Tax (c) Concept of Time, Value & Place of Taxable Supply (d) Input Tax Credit, Computation of GST Liability & Job Work (e) Procedural Compliances under GST (f) Basic Overview on IGST, UTGST and GST Compensation Cess (g) Overview of Customs Act.

Read More

Specifications

Book Details

| Imprint |

|

| Publication Year |

|

| Edition Type |

|

| Book Type |

|

| Number of Pages |

|

University Books Details

| Stream |

|

| Specialization |

|

| Term |

|

Dimensions

| Width |

|

| Height |

|

| Depth |

|

| Weight |

|

रेटिंग और रिव्यू

4.5

★

19 Ratings &

0 Reviews

- 5★

- 4★

- 3★

- 2★

- 1★

- 14

- 2

- 1

- 2

- 0

Have you used this product? Be the first to review!

Safe and Secure Payments.Easy returns.100% Authentic products.

Back to top