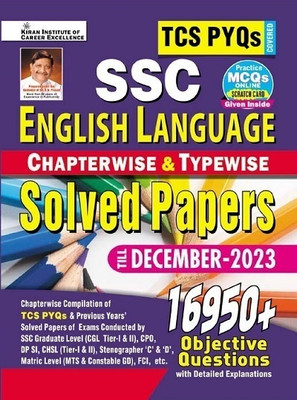

Taxmann's Commentary Combo For Direct Tax Laws | Master Guide To Income Tax Act & Rules And Direct Taxes Ready Reckoner | Finance Act 2023 Edition | A.Y. 2023-24 & 2024-25 | Set Of 3 Books (Paperback, Dr. Vinod K. Singhania, Taxmann)

Price: Not Available

Currently Unavailable

Highlights

- Author: Dr. Vinod K. Singhania, Taxmann

- 4264 Pages

- Language: English

- Publisher: Taxmann Publications

Description

These books, authored by Taxmann's Editorial Board & Dr Vinod K. Singhania, are a COMBO for the following books on Direct Tax Laws: (1) Taxmann's Master Guide to Income Tax Act | 33rd Edn. | 2023 (2) Taxmann's Master Guide to Income Tax Rules | 30th Edn | 2023 (3) Taxmann's Direct Taxes Ready Reckoner | 47th Edn | AYs 2023-24 & 2024-25 The key features of these books are as follows: Taxmann's Master Guide to Income Tax Act This is a unique book that covers the following: (1) [Section-wise Commentary] on the Finance Act 2023 (2) [Ready-referencer for All-important Procedural Aspects] of the Income-tax Act (3) [Gist of All Circulars & Notifications] Section-wise, which are still in force (4) [Digest of Landmark Rulings] are given Section-wise The Present Publication is the 33rd Edition & has been amended by the Finance Act 2023. This book is authored by Taxmann's Editorial team, with the following coverage: (1) [Division One] (a) Section-wise commentary on the Finance Act, 2023 (1) Tax on Winning from Online Games (2) Taxation of Life Insurance Policies (3) Taxation of Charitable & Religious Trusts (4) Agniveer Scheme (5) Business Income (6) Capital Gains (7) Other Income (8) Deductions & Exemptions (9) New Tax Schemes (10) TDS/TCS (11) Assessment & Refunds (12) Penalties & Prosecution (13) Appeals & Dispute Resolution (14) Transfer Pricing (2) [Division Two] (a) Income Tax Practice Manual (1) Deduction of tax at source (2) Collection of tax at source (3) Return of Income (4) Assessment/Reassessment (5) Rectification of mistakes (6) Payment of tax/interest & refund of taxes (7) PAN & Aadhaar (8) Statements of Finance Transactions (SFT) (9) Advance Tax (10) Interest & Fees (11) Refunds (12) Faceless Proceedings (3) [Division Three] (a) The Gist of all Circulars, Clarifications & Notifications (i) From 1961 – February 2023, with Section & Alphabetical key for easy navigation (4) [Division Four] (a) Digest of all Landmark Rulings (i) From 1922 – February 2023, with Section & Alphabetical keys for easy navigation Taxmann's Master Guide to Income Tax Rules This book provides an in-depth Rule-wise commentary on the Income-tax Rules 1962. The Present Publication is the 30th Edn & incorporates all amendments till the Income-tax (3rd Amd.) Rules, 2023. This book is authored by Taxmann's Editorial Board with the following noteworthy features: (1) [Detailed Analysis] on every Rule of Income-tax Rules 1962 (2) [Statutory Background of the Section] that helps you understand the enabling provisions, compliances required & the legislatures' intent behind the law (3) [Case Laws] are included within the text to aid the interpretation of the law further (4) [Simplified Language] to explain each provision of the Income-tax Rules (5) [Illustrations] to quickly understand the complexities of the Rule (6) [Gist of All Circulars & Notifications] issued by the Department in each Rule, which are in force (7) [Income-tax Compliances] to be done in each Rule Taxmann's Direct Taxes Ready Reckoner Taxmann's bestseller for 40+ years, is a ready-referencer for all provisions of the Income-tax Act, covering an illustrative commentary. The Present Publication is the 47th Edn. & has been amended by the Finance Act 2023 for AYs 23-24 & 24-25. This book has been authored by Dr Vinod K. Singhania, with the following noteworthy features: (1) [Focused Analysis] without resorting to paraphrasing of sections & legal jargons, on the following: (a) [Amendments made by the Finance Act 2023] are duly incorporated in respective chapters & are appropriately highlighted (b) [Comprehensive Analysis of Amendments with Illustrations] are given separately in Referencer 2: Amendments at a glance (c) [Case Studies on Complex Provisions] are given to understand the implications of the new provisions & amendments in the existing provisions, including: (1) Section 43B – Consequences of making late payment to micro & small enterprises (2) Section 44AD & Section 44ADA – Increase in the threshold limits for presumptive taxation scheme (3) Section 50AA – Special provision for computation of capital gain in the case of a unit of specified mutual fund or market-linked debenture (4) Section 54 & 54F – Limit on the exemption that can be claimed (5) Section 56(2)(xiii) – Tax on the sum received under a life insurance policy (6) Section 87A – Rebate under alternative tax regime (7) Section 115BAC – Alternative Tax Regime (8) [Analysis of all Provisions of the Income-tax Act] along with relevant Rules, Case Laws, Circulars & Notifications (2) [Analysis on Alternative Tax Regime] along with Break-even Tables (3) [Faceless Tax Proceedings] provides the summary of all the legal provisions (4) [Tabular Presentation] of all key provisions of the Income-tax Act (5) [Computation of Taxes] on various slabs of income (6) [Ready Referencer] for tax rates, TDS rates, TCS rates, due dates, etc. (7) [Zero Error] Follows the six-sigma approach to achieve the benchmark of 'zero error'

Read More

Specifications

| Book |

|

| Author |

|

| Binding |

|

| Publishing Date |

|

| Publisher |

|

| Edition |

|

| Number of Pages |

|

| Language |

|

| Genre |

|

| Book Subcategory |

|

Ratings & Reviews

4.3

★

4 Ratings &

0 Reviews

- 5★

- 4★

- 3★

- 2★

- 1★

- 3

- 0

- 0

- 1

- 0

Have you used this product? Be the first to review!

Be the first to ask about this product

Safe and Secure Payments.Easy returns.100% Authentic products.

Back to top